“I figured out how to make the money. You fellows will have to figure out how to spend it.”

With every fall comes auburn leaves, overpriced pumpkin lattes, and palpable excitement over an obscure merit-based lottery only a few can ever hope to achieve.

That time of year where The MacArthur Fellows Program doles out their annual allotment of $625,000 to those “who have shown extraordinary originality and dedication in their creative pursuits.”

Among the most famous recipients of the “genius grant” are civil rights activist Marian Wright Edelman, Stanford biologist Paul R. Ehrlich, and choreographer Twyla Tharp.

A truly amazing achievement. A time for celebration of exceptionalism in unadulterated charity. A possible day of recognition in the future for the ingenious invention of the peanut butter tuna sandwich.

But the reason to create the benevolent $7.5 billion private foundation in the first place is almost equally malevolent.

The Founding Father

The foundation was founded (yes, me write good words) by none other than John D. MacArthur. Born in 1897 in relative poverty, John went on to pursue education to the highest aspirational levels of the modern-day conservative movement.

He dropped out in the eighth grade.

Of note, the Basic Ethics and Morals 101 was likely a class in grade 9.

John’s father was a Baptist preacher. His brother won an Academy Award as a screenwriter. His sister-in-law was the famous actress Helen Hayes. Another brother owned a small insurance company.

John went into sales.

He tried out a few different jobs over the early years, but one niche kept dragging his interest back to the desk. Selling insurance.

He got a taste of insurance early on working with his brother. People got a taste of John’s ethics later on when he left his first wife and two children to marry his hot secretary.

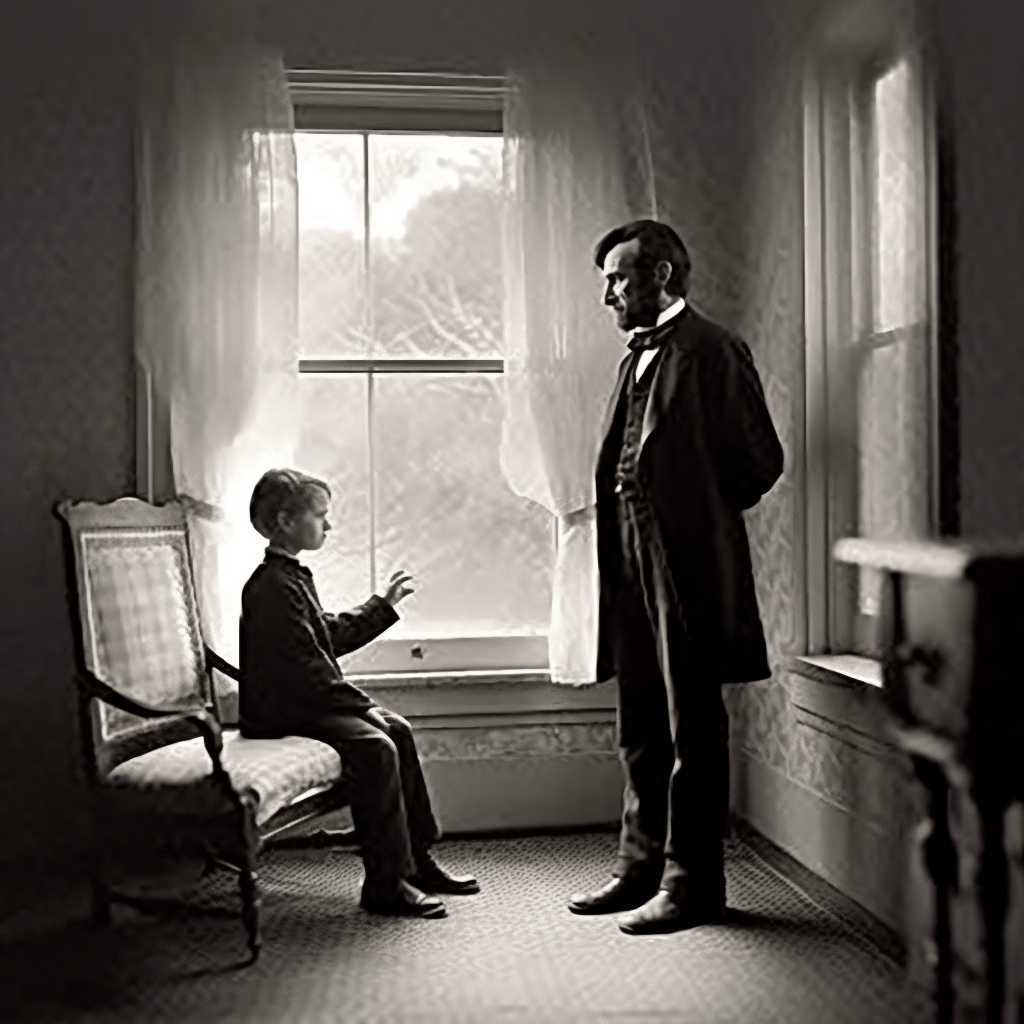

Now with a bit of cash — her family was somewhat wealthy — they went and bought a struggling small life insurance company called Banker’s Life and Casualty, running the company alongside his new investor-with-benefits.

Too Poor to Insure?

One century ago, most life insurance was only affordable to the wealthy class. John set out to change that by offering industry-breaking $1 policies and heavily advertising them in local newspapers around the country.

He also took the innovative step of mailing out his offer to thousands of homes in a flyer, something uncommon at the time. It may or may not be a coincidence Spam was invented around then, too.

Regardless of relation to delicious canned goods, it seemed John had a decent flair for marketing. But alas, he really should’ve attended that grade nine ethics class.

Business Was Booming

Sales exploded but costs didn’t. A sure recipe for success if there ever was one. Customers around the U.S. could now afford insurance, regardless of income level.

Marketing accolades rolled in. Business groups praised his new-age jazzy style of doing insurance. 14 state insurance departments even gave him a call to chat.

It turns out, Johnny boy had a few unwritten policies most customers were unaware of:

Policy #1: His company frequently made “mistakes” in the addresses of insurance payout checks. The exact same houses with correctly written addresses for the initial advertisements (spam).

Policy #2: It was standard practice to discard claims — perhaps even automatically — and instead only helped customers if they repeatedly chased them.

Denying people their legally due payments in their greatest time of need?

“No problem!” — John, Probably.

Yet another strike in the long list of massive companies who made their fortunes off of scamming hard-working Americans out of their money. In this case, people likely went bankrupt, lost their homes, livelihoods, and more.

Hurray for bootstraps!

It’s Never Too Late to Change

But don’t worry my young leftist friends, he changed his ways. His company received countless accolades in the 1940s for being one of the only large employers in the country to employ hundreds of older and handicapped workers.

Such a drastic society-benefiting work policy that pre-dated many workers’ rights legislations? By god, this man was a visionary! So, of course, the press praised him. You would praise him. I would praise him. Who wouldn’t?

John received so much positive press about the employment policy he self-financed a documentary to show how great his idea (he) was.

“America’s Untapped Assets” was shown frequently on TV as a public service and eventually resulted in John getting a special commendation from the President’s Committee!

The crux?

“(The) basement ceilings were unusually low. … Bankers was still able to make this usable space, however, by hiring dwarfs as custodians.”

It turns out Bankers Life’s office building had a lot of nearly unusable space in its cramped basement. That’s not a problem if you’re named John and hire “dwarves” and wheelchair-bound employees to work in those claustrophobic possibly dangerous quarters.

I’m sure his Employee Wanted Ads said something along the lines of “You’ll fit right in!” in the brazen version of political correctness of the time.

Scam One, Scam ’Em All

At one point, his second wife left him after discovering a few minor details of the man she married:

- They were never legally married 20 years earlier.

- She wasn’t legally entitled to any part of this new massive life insurance industry.

- He had attempted to secretly seize ownership of his wife’s stock.

- He frequently enjoyed groping unwilling female employees.

Fortunately, she eventually came to her senses and reunited with him. Because — money? They worked out their differences and put her legally on the books for everything.

All’s Well That Ends Well. For Billionaires.

Years later when it came time to retire, John had another problem. He was one of only two billionaires in all of the US! Wait, that was society’s problem, not his.

Phew, I’m sure glad we solved that one and don’t have 724 of them now.

His real problem?

He didn’t want his left-leaning kids wasting his hard-won fortune. And since he didn’t want to leave his wealth to them, that meant the government would get its dirty dirty paws on his life-denying money and business.

His will “was a disaster from a tax and estate planning perspective…The federal government would take most of it in taxes.”

That’s a big no-no in billionaires books if you haven’t been paying attention.

Benevolence at its Finest

What do you do if you’re one of the richest people in the world and don’t want to pay taxes?

Start a charity! A strong tradition that continues to this day.

He set up the MacArthur Fellows Program with the mission to avoid taxes, ensuring his fortune would keep on benefitting absolutely no one. He filled it with a bevy of conservatives; radio commentator Paul Harvey, two Banker’s Life executives, and former Nixon administration Treasury Secretary William Simon.

He also plopped his son on the board, J. Roderick MacArthur, having reconciled their relationship in his older years.

His staunchly liberal son.

The MacArthur Foundation

John had a simple message to the board members:

“I figured out how to make the money. You fellows will have to figure out how to spend it.”

And they did.

They promptly started distributing the money to all of their favorite heavily conservative causes of the time. Presumably anything related to prolonging the suffering of 90% of Americans. And guns for babies.

But his son had his own thoughts on the organization:

“The idea behind the foundation was as a tax dodge that he [his father] thought would allow his business executives to run his company forever. He clearly didn’t understand the tax laws.”

The next few years involved Roderick trying to wrest control over the foundation from his uber-conservative counterparts.

- He expanded the board to 13 from 6 and included members from academia, science, and government in 1979

- He ardently opposed any funds going to purely conservative political causes and battled Nixon’s Treasury Secretary until the conservative resigned in disgust

- In 1984, Roderick filed suit against several of the board members who continued spouting conservative causes and were profiting from the donations, eventually dropping the suit a month before his death from cancer

Fast Forward

While Roderick died before seeing most of his dreams for the foundation come to fruition, his actions had a long-lasting effect on the organization.

They implemented many of his changes in the years after his death. General observers now feel the “genius grant” is rationed out to left-leaning causes.

They just might be right. Its current mission involves funding for several broad causes:

- Climate change solutions

- Prison and justice system reform

- Disease research

- Decreasing nuclear risk

- Supporting nonprofit journalism

I couldn’t create a more anti-MAGA list of goals if I was paid to by Hillary.

The MacArthur Foundation is now in the top 15 of the wealthiest charities in America. It’s given away more than $7 billion in grants since its first donation in 1978. It’s one of the world’s leading contributors to funding liberal causes.

And yet, it was founded on the greedy notion of dodging tax and perpetuating a giant organization built on defrauding poor Americans who just wanted to help their families.

And that’s how a massive insurance fraud turned out to be great for society in the end.

If that isn’t irony at its finest, I don’t know what is.

J.J. Pryor

Head over here for more of my shenanigans.

References:

- https://www.macfound.org/media/files/jmct.pdf

- https://abcnews.go.com/Business/story?id=4418512&page=1

- https://www.washingtonpost.com/archive/local/1978/01/07/john-macarthur-80-from-salesman-to-modest-billionaire/0c799196-255e-453d-9f1a-65a2a3c3788f/

- https://web.archive.org/web/20070312074758/http://www.learningtogive.org/papers/index.asp?bpid=152&print=yes

- https://en.wikipedia.org/wiki/J._Roderick_MacArthur

- https://www.macfound.org/about/

- https://theweek.com/culture/1005474/whats-a-genius

- https://www.pionline.com/article/20181112/ONLINE/181109876/the-largest-foundations

- Photo Credit: “The family friend,” insurance advert, Library of Congress