MacKenzie Scott has now donated 8 billion dollars of her personal wealth to charities. While that act is noble in itself, her estimated wealth increased $23 billion during the same period.

Jeff Bezos’s ex-wife literally can’t give her money away fast enough.

Because she shouldn’t have had that much money in the first place. Neither should her ex-husband have. And neither should the other 717 billionaires in America.

719 people who collectively now own more than 4x the wealth of the bottom half of Americans.

Wealth is Out of Control and Charity is Making it Worse

We’ve now entered the age of philanthrocapitalism, where the world’s richest CEOs, genetic lottery winners, and fake-tanned narcissists all donate vast amounts of money to varying causes.

Causes they get to choose. Causes that may not be charitable at all. Causes that are unknown and often untracked.

Yet in nearly every case, when the mega donations start rolling out, these billionaires receive countless accolades, applause, and adoration.

We shouldn’t be so quick to cheer them on for their humble acts, though. Because many non-profits are set up purely to avoid taxes.

The Wealth Gap

Just 31 years ago, the wealth situation was slightly reversed, with the richest owning less than half of Americans. In fact, billionaire wealth has novemdecupled since 1980. That’s an astounding 19x for those that didn’t also want to look up the unusual term.

One-third of that novemdecupling was during the pandemic alone.

For the average American? It’s a bit far from the mountainous 18,000% increase enjoyed by the rich over the same period.

“The fact of the matter is there has been class warfare for the last thirty years.” — Senator Bernie Sanders

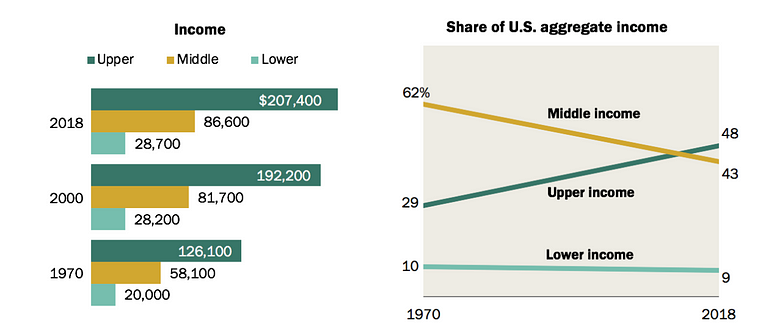

According to Pew Research — income increased less than 50% for the non-elites since 1970:

While the reasons for the ever-increasing inequality gap are plenty, charitable donations are certainly a contributor.

But the act of charitable giving has taken on a force of its own in recent years — for the rich.

While your average run-of-the-mill American Joe looks forward to paying roughly 10% in federal taxes every year, 25 of the richest billionaires paid a ‘true tax rate’ of only 3.4%.

One amazing way to achieve that low rate? Donate to charity.

Private Foundations and Donor Advised Funds

The uber-wealthy simply don’t contribute money the same way as you or me. One of the ways they abuse the charity tax system is through the use of private foundations and donor advised funds (DAFs).

This latter financial vehicle is by far the more egregious of the two — if you want to save millions on your taxes, that is.

Why? There are three main reasons.

Minimum Spending Requirements

Unlike private foundations, which are required to give out at least 5% of their assets per year, DAFs don’t have any distribution requirements. You can park your billions in a DAF and leave it untouched for decades. Free from the taxman and free from being distributed throughout society.

Tax Savings

It allows wealthy people to immediately reap enormous income tax reductions for appreciated assets, even though the money doesn’t need to be spent right away. Essentially, they use DAFs to avoid paying any capital gains by donating the shares instead. Those donations then become deductable against any income tax owed from elsewhere.

Disclosure

DAFs are also not required to state where their donations are going or who holds what amounts. Is your child approaching college-age and you’re worried about their chances of getting accepted? Why not donate over $37 million to the top colleges in the country for a few years first. Tax-free, baby.

How to Save $500 Million on Your Tax Bill

DAFs are a fantastic way to store your wealth for a rainy day if you have a few billion to spare. It’s why some people refer to them as a form of a charitable checking account — because they certainly aren’t meant for charity alone.

If you’re facing a gigantic tax bill in any particular year, just make an unaccountable giant donation to your very own DAF and get that bill down to $0 — ASAP.

Kind of like how the literal embodiment of a tech bro, Nicholas Woodman — the founder and CEO of GoPro — did when his company went public in 2014.

During the same year, his incredibly successful company earned him $3 billion in stock from an IPO. He suddenly had an overwhelming charitable feeling and donated $500 million to a DAF.

“We wake up every morning grateful for the opportunities life has given us. We hope to return the favor as best we can.” — Mr. & Mrs. GoPro TechBro

It was huge. People lauded them for their extreme generosity and giving back almost 1/6th of their hard-won earnings.

Fast forward four years later after an investigation by the New York Times, and there was only one public record of a donation from the same DAF account — an unspecified amount given to a fundraiser called “The Bonny Doon Art, Wine, and Brew Festival.”

The only way I’d give applause for that donation was if Mr. Tech Bro personally drank $500 million in booze that day. I’ve only come anywhere close to that amount while partying in Bali and using Rupiah.

The $500 million he donated was almost surely used to massively decrease his tax bill that year to relatively nothing. A tax bill that would’ve been in the hundreds of millions.

The simplistic math of long-term capital gains taxes would put that number at somewhere around 15% of $3 billion — $450 million.

A $500 million deductible charity donation vs $450 million in potential taxes? Surely it must be a coincidence and definitely not an extreme form of legalized tax evasion.

The Donation Distribution

I can hear a thought stirring among some of you:

“How dare you? Charitable donations step-in where the government fails!”

And while this point may be true for a large number of donations, which one of the following would you consider truly being a worthy cause? In 2019, American individuals, foundations, bequests, and corporations gave away almost $450 billion according to Giving USA.

That is an amazing number. But the breakdown of giving might reveal some surprises for you.

- Religion — 28% ($128 billion) was given out to tax-free religious organizations. Like to evangelist preacher Kenneth Copeland’s organization. A piously humble pastor, who is worth over $300 million, has a huge mansion, an airport, a fleet of private jets, and definitely isn’t a demon in a sh*tty disguise.

- Education — Next in line was education with just over 12% ($64 billion), including many universities and endowment funds. You know, the bastions of advanced society which the government used to supply funding for, without playing favorites of billionaire’s children.

- Human services — 12.5% ($56 billion) was given to help provide child services and family care, something that should probably be paid for by society — the thing that ends up usually causing the problems in the first place.

- Foundations—Another 12% ($53.5 billion) was given to other foundations. Pretty meta. And damn confusing.

- Health organizations — A touchy subject in recent years, donations totaled about 9% ($41.5 billion) for healthcare in 2019. That doesn’t quite make a difference to the 44 million Americans without health insurance.

- Public society benefit — 8% ($37 billion) was given to organizations trying to improve the civil rights, liberties, and welfare of all Americans.

- International affairs — 6% ($29 billion) was given to help other countries. Or to help billionaires like George Soros and the Koch brothers spread their influence globally — tax-free.

- Arts, culture, and humanities — 5% ($22 billion) was spent helping promote the arts throughout the country. Or to help uber-rich people like Peter M. Brant build tax-exempt personal museums right around the corner from their houses. Don’t forget the side benefit — DAFs allow them to write off all those precious artworks at a ‘market price’ of their choosing, essentially giving them a blank check for tax breaks. Yay!

- Environment and animal organizations —Last on the list, a lowly 3% ($14 billion) was spent saving the planet from ourselves. Where are our priorities?

All of these charitable donations sound nothing short of amazing on the surface. It’s only when you start peaking through the oft-hidden cracks that some of the crazy wealth-motivated truths start poking out.

There’s also another way to think of this money.

These charitable donations are tax-free. An unknown but not insignificant number of them are being used to help some billionaires pay literally nothing in taxes.

Those foregone taxes — instead of being spent on helping society and being distributed equally — are repurposed to keep the super-rich, well, super rich.

And it doesn’t end there.

The Compound Effect of Charity

As if the idea of billionaires paying $0 in tax in any given year isn’t shocking enough, consider the added effect of time.

The marvelous Albert Einstein once said, “compound interest is the eighth wonder of the world.”

And it’s true. The power of compounding can achieve awe-inspiring results — double a special penny every day for a month and you’ll end up with over $5 million.

Or keep your charitable investments tax-free — a form of mega compounding — and you’ll end up like the Mormon Church.

One of their own financial advisors became so disgusted with the organization that they blew the proverbial whistle. He provided evidence the Mormon Church stockpiled over $100 billion in an investment account without using a single dollar on charitable activities in 23 years.

But at least they gave out significant funds to two different for-profit entities.

Or you could take a gander at wealthy university endowment funds, who until recently, accumulated investment wealth completely tax-free.

Harvard, for instance, has an investment fund worth over $59 billion. Or put another way — $2.6 million per enrolled student.

If only that money could be used to actually, you know, educate people.

Instead, it sits there accumulating a useless virtual number in a virtual cell on some financier’s virtual spreadsheet. Sometimes I feel like virtually puking.

Considering the combined college endowment funds in the US tops at least $600 billion (as of 2019) and there’s almost $1.6 trillion in outstanding student debt, I can figure at least one way to reduce that debt load.

Certain tax-free charitable entities are accumulating tremendous amounts of wealth in our society — instead of being spent throughout the economy on those who need it most.

Charity is for the Rich

In case you’re still in doubt these charitable donations aren’t a massive tool for the rich, keep in mind Trump’s big tax reduction in 2017 had the indirect effect of cutting the number of people declaring charitable donations by 50%.

The half that was cut? You guessed it. It sure wasn’t rich people.

Around 75% of the 21 million people who now claim the charitable deduction on their taxes make more than $350,000 a year.

Those generous souls who weren’t rich and still bothered claiming their donations? They earned an average tax break of $20. No million or billion behind that number.

Gone are the days of being generous for the sake of generosity. Charity is no longer meant to be charitable, either. In its current legal form, it’s almost entirely meant for the wealthy to become wealthier.

Society Has Changed

If I come across as being anti-charity, I truly am sorry. I’m not.

I’m anti-corruption. I’m anti-oligarchy. I’m anti-mega-wealthy individuals using legal forms of bribery over the course of decades to slowly change the entire tax code to ensure they retain their power at all costs.

It’s why America doesn’t have socialized healthcare. It’s why the US has the most guns per capita in the world. It’s why the United States takes up 39% of all military spending globally. It’s why lobbying isn’t called bribery.

It’s why the rich are wealthier than anyone in history in a country built upon the pursuit of life and liberty and happiness for all. They use their wealth to install their politicians who create their rules and push their industries.

These are no longer equal pursuits. The uber-rich learned modern democracy doesn’t usually stand idly by while someone directly picks your pockets.

And unfortunately, they turned a noble act like giving to charity into a wealth generation vehicle. The utterly shocking and ingenious part of it?

We applaud them for doing it.

We clap and praise and sing Twittery songs about how amazing Elon Musk is while he takes $4.9 billion in government subsidies and pays $0 in federal taxes in 2018. A man who then has the gall to say a stimulus package “is not in the best interests of the people.”

We shout at the top of our lungs in praise while Amazon pays next to nothing in taxes and kills thousands of small businesses across the world.

We vote in narcissistic populist a*sholes who don’t have a shred of real beliefs in their body — other than making sure every single action will benefit themselves personally.

We are just ants helping them build hills of money, power, and praise, all with the sole purpose of feeding their mountainous egos.

They have taken us for fools. And in a sick sense, they’re right to do so.

Takeaway

While a big chunk of the world was busy in lock-down wondering where their next meal might come from, billionaires’ increased their wealth in the pandemic by more than $4 trillion.

They argued against stimulus packages. They came up with nice nifty terms like ‘essential workers’ before laughing in their faces when they asked for raises. And fire them for trying to unionize.

We all know the rich are in it for themselves, but we always knew they’d be kept in place. But that assumed a fully functioning democratic system with proper checks, balances, and a legal system actually enforcing laws equally.

As Supreme Court Justice Louis Brandeis once said:

“We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we can’t have both.

So next time you hear someone praising a billionaire for giving away incredible amounts of money to their favorite “causes,” try to remember this fun statistic:

“For every dollar a billionaire gives to charity, the rest of us chip in as much as 74 cents to make up for the lost revenue.” — Inequality.org

When billionaires like MacKenzie Scott appear to be genuinely trying to help and donate billions to worthy organizations — do not thank them.

Thank yourself instead. After all, you paid for it. And they probably got richer while you did it, too.

Head over here for more of my written shenanigans.

I almost leave no comments for articles. But this one, moved me.

I am interested in these subjects and didnt find any detailed materials on how the rich avoid paying taxes. They all just say “re-invest” and bla bla bla… Which doesnt make sense. However, with your aticle, everything is clear now.

I swear many of the famous philanthropist people you mentioned in your article don’t have good eyes. They look like dark schemy bastards and I never trusted them. I know these acts of charitty are for shows but couldnt nail it down until now. We have such a corrupt government. Thank you and I will deff share this with others.

Thanks for reading and replying Abubaker. If you’re interested in this, there’s another related article about how the rich avoid huge amounts of taxes. https://threwthelookingglass.com/two-secret-tax-loopholes/ Take care.